Cloud POS: Trending now at fast-casuals and QSRs.

By Kevin W. Jaskolka

As restaurant chains continue to prioritize innovation, the successful implementation of effective technology is more crucial than ever. The point-of-sale (POS) system is the front line for restaurant operators to explore new avenues with technology, a catalyst for turning trends into sales.

Cloud POS systems represent a significant growth channel and can put restaurant operators in an advantageous position to capitalize on consumer needs and competitive opportunities. To highlight these opportunities, cloud POS provider ParTech, Inc. partnered with foodservice researcher Technomic to illuminate relevant, impactful restaurant trends and best practices, while providing actionable, executive-level takeaways geared toward operators in the fast-casual and quick-service segments.

Fast-Casual’s Rapid Growth

Fast-Casual’s Rapid Growth

The restaurant industry’s dynamic and ever- evolving nature creates myriad opportunities and challenges for operators. One of the most transformative developments over the past decade has been the rapid-fire emergence of fast-casual. A disruptor to the two more-established restaurant segments, fast-casual fills a gap that existed between the convenience and lower price points of quick-service and the higher quality of food, service and ambiance at casual dining.

Over time, restaurant companies identified the sweet spot in that gap — keeping price points comparably low, while heightening the quality of menu ingredients and elevating restaurant designs, ambiance and service. Consumers responded by rewarding fast-casuals with increased traffic and spend. And with its particular relevance among younger consumers, fast-casual is only poised to continue its rise.

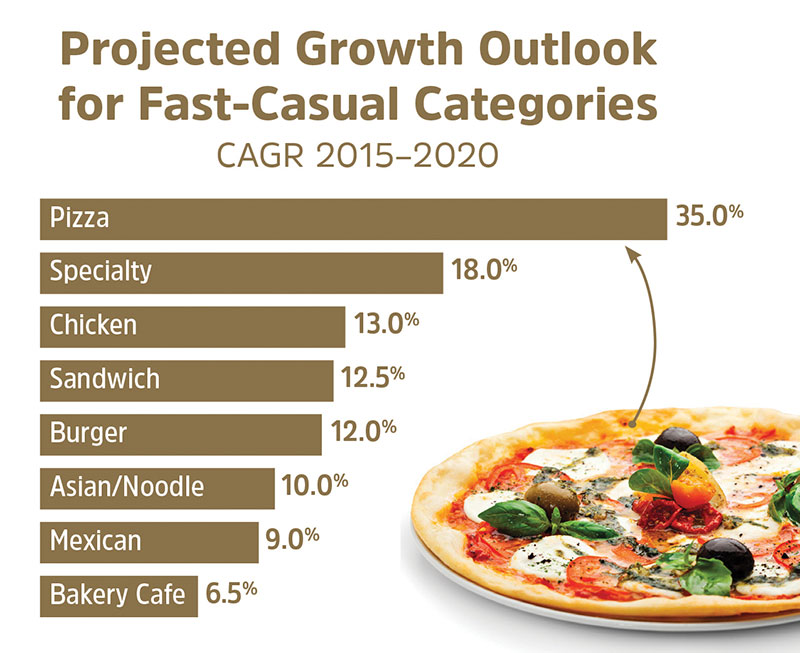

Today, fast-casuals have matured to the point where they are truly driving growth of the entire industry. While quick service represents the lion’s share of the restaurant business in terms of both units and overall sales, the sheer growth pace of fast-casuals is staggering: Technomic’s most recent sales data shows that fast-casuals grew sales roughly 12% in 2015 — nearly triple the 4.4% growth rate of traditional QSRs.

Visibility Beyond the Four Walls

As the hottest segment in the restaurant industry, fast-casual is crowded with concepts both large and small, conventional and creative, each trying to maximize efficiency and consistency as they expand. As these chains scale, they need solutions that will help them to maintain the same quality and service standards throughout each phase of their growth plan.

One of the biggest-impact upsides for operators migrating to cloud POS is the ability to have a real-time window into their operation from any remote location, with nothing more needed than a device and internet access. This anywhere accessibility works for any size chain, from a three-unit upstart to an established 200-unit chain, and gives operators the tools and data they need at their fingertips to run their business and free up staff at the unit level.

One of the biggest-impact upsides for operators migrating to cloud POS is the ability to have a real-time window into their operation from any remote location, with nothing more needed than a device and internet access. This anywhere accessibility works for any size chain, from a three-unit upstart to an established 200-unit chain, and gives operators the tools and data they need at their fingertips to run their business and free up staff at the unit level.

Online & Mobile Ordering

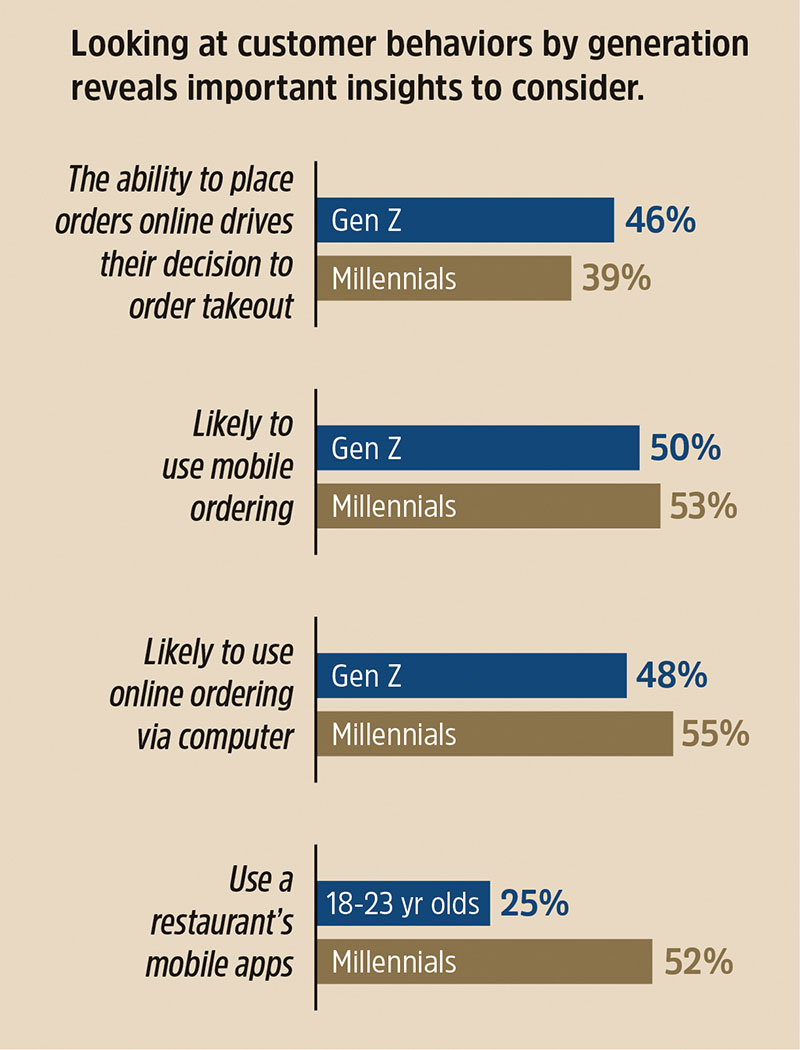

Consumers have been quick to adopt online and mobile ordering at restaurant chains — and fast-casuals and QSRs have been particularly swift to make this technology more widely available. For consumers, the enhanced convenience and speed of online and mobile ordering supports increasingly on-the-go and time-pressed lifestyles with a simple and familiar solution. Consumers and operators share the benefit of improved order accuracy, while operators also reap the benefits of a greater amount of usable data on their customer’s behavior.

Analyzing Technomic’s most recent generational data on mobile and online ordering, it’s clear and likely not very surprising that younger generations place the highest importance on the availability of these platforms. While today’s restaurant and tech companies are smart to target younger consumers, they shouldn’t ignore their older customers. Technology like mobile and online ordering can enhance convenience and the overall experience for this group too; in fact, 43% of Gen X consumers make use of a restaurant’s mobile apps — a much higher percentage than Millennials.

Some of the newest apps to debut at fast-casuals and QSRs feature next-level functionality that illustrates how trends are advancing for these platforms:

Some of the newest apps to debut at fast-casuals and QSRs feature next-level functionality that illustrates how trends are advancing for these platforms:

• Domino’s new Zero Click ordering app lets users place speedy orders by linking to an existing Domino’s profile with saved Easy Orders.

• Blaze Pizza’s new app offers mobile ordering and payment, as well as a nutrition calculator and new loyalty program that offers rewards for usage.

Emerging Payment Methods

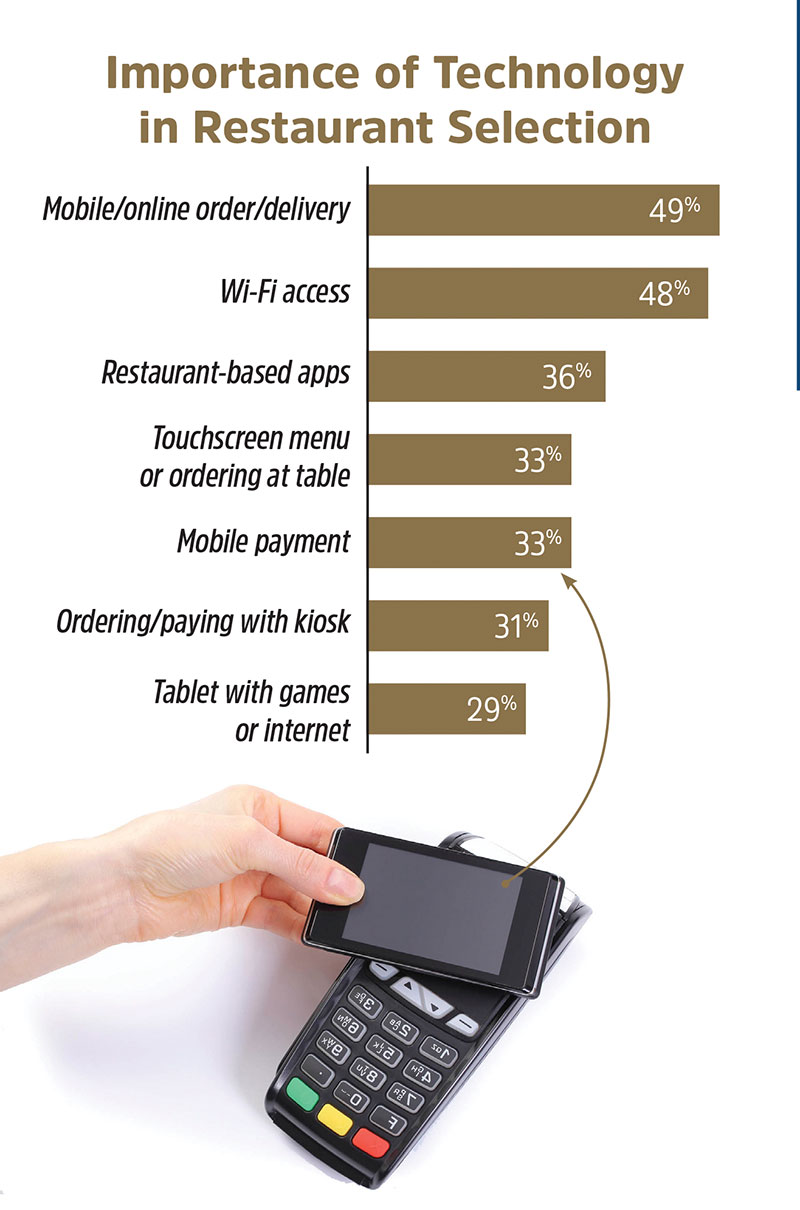

Next-gen payment options are appearing across the restaurant landscape. Most of these contemporary tools call for touchscreen modules in the restaurant. In addition to on-trend tablet, kiosk, tabletop, mobile-app and online ordering and payment systems, newer payment platforms are also emerging at both fast-casuals and QSRs.

Cashless payment methods through smartphones are moving to the forefront. A number of influential chains in the QSR segment, including McDonald’s and Dunkin’ Donuts, now accept cashless-payment options via systems like Apple Pay, Samsung Pay and Google Wallet. Recent Technomic data on changing consumer demographics and attitudes shows that a full third of consumers consider cashless, smartphone-based payment options like Apple Pay and Good Wallet as important drivers that influence their visitation, with nearly a third saying the same of kiosk payment.

Loyalty

The importance of an impactful loyalty strategy can’t be understated. Technomic’s data shows that a large percentage of consumers expect and use loyalty programs and rewards when they dine out. Further, loyalty programs are the catalysts that can turn first-time guests into loyal fans. So when menus and price points are not enough to differentiate from competitors, offering a compelling loyalty program can help brands stand out from one another and drive traffic.

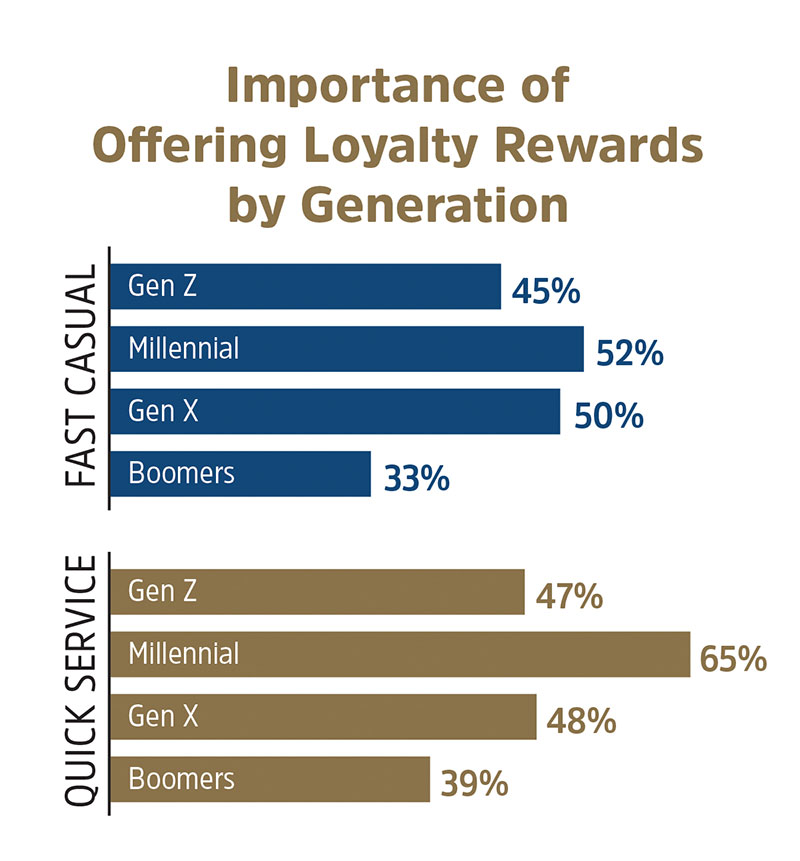

Generational attitudes and preferences are an important aspect to consider. Loyalty and rewards platforms matter much more to younger consumers than to their older counterparts. This is likely due to younger consumers making loyalty a larger part of their overall value equation than older diners.

To expand the reach of loyalty and rewards programs, restaurants can use the well-rounded cloud data they gather to gain access to valuable customer information. This data gives operators leverage to create personal rewards for their customers and drive guest engagement. Loyalty is also becoming more entrenched as an expectation for restaurant-goers — particularly in the fast-casual segment, where the growing importance of loyalty rewards is outpacing QSRs.

To expand the reach of loyalty and rewards programs, restaurants can use the well-rounded cloud data they gather to gain access to valuable customer information. This data gives operators leverage to create personal rewards for their customers and drive guest engagement. Loyalty is also becoming more entrenched as an expectation for restaurant-goers — particularly in the fast-casual segment, where the growing importance of loyalty rewards is outpacing QSRs.

The bottom line on loyalty programs is that they extend far beyond a mere service amenity. They exist to fulfill a consumer need that continues to grow in importance, and can function as a visit driver.

Security

Data security has become a paramount issue at restaurants as technology advances and consumers’ greater reliance on personal devices for payment rather than cash for dining transactions grows.

In recent years, a number of top retailers and restaurant brands have been vulnerable to data breaches and have seen their customers’ credit card information compromised. This of course is bad for affected consumers, but for operators, it erodes the brand equity they work so hard to build.

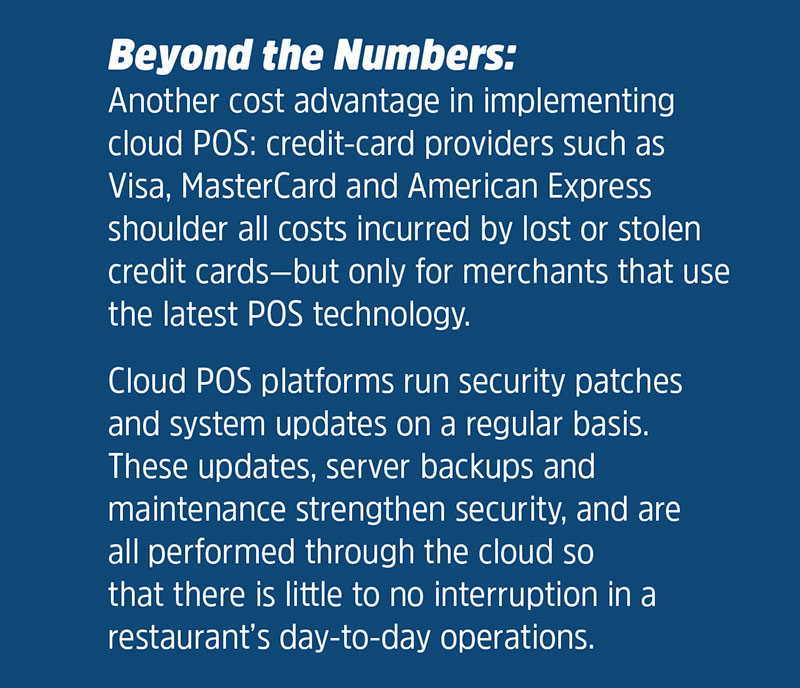

The good news for restaurant companies and consumers alike is that the new chip-embedded credit cards are leading to lower levels of data incidents worldwide. The greater visibility enabled by cloud POS also allows operators to stay on top of potential fraud incidents even from remote locations.

Data/API

One of the other major factors to consider when looking at migrating to a new cloud POS system is how well a platform integrates existing and future technologies.

A system with an Application Program Interface (API) that works well with third-party applications enables operators to quickly adapt to the latest technology to keep up with consumer demands. At the same time, it also allows operators to get the most out of the data collected through these various platforms by essentially connecting all the dots.

With cloud POS, data is safer and more secure, and is remotely accessible without requiring a long term contract. Additionally, offline mode keeps operations seamless during service interruptions, with automatic data synched once operations come back online. Cloud POS also helps restaurant chains streamline their IT operations, reduce the footprint of their data center and be in a prime position to rapidly adopt new features and functionality.

With cloud POS, data is safer and more secure, and is remotely accessible without requiring a long term contract. Additionally, offline mode keeps operations seamless during service interruptions, with automatic data synched once operations come back online. Cloud POS also helps restaurant chains streamline their IT operations, reduce the footprint of their data center and be in a prime position to rapidly adopt new features and functionality.

Cloud POS makes it easier for restaurants to get on board with newer, more secure technologies, such as EMV chip cards. Chip features protect in-store payments by generating unique, one-time codes to approve payments — effectively reducing in-store counterfeit fraud.

Liability laws are changing, putting merchants at risk of being liable for counterfeit transactions from magnetic-strip cards. Because cloud POS more easily facilitates the adoption of chip technologies, it can act as a powerful tool for restaurants in strengthening their payment card industry (PCI) compliance standards, by helping to eliminate the risk of liability of fraudulent card activity.

Finally, software as a service (SaaS) on the cloud is a vital point of distinction. What makes SaaS advantageous for restaurant operators that install cloud POS is that all upgrades, bug fixes and new features are performed automatically and across the entire system.

— Kevin W. Jaskolka brings 20 years of marketing and sales experience to his role as vice president of marketing for PAR, which offers technology solutions for the full spectrum of restaurant operations, from large chain and independent table service restaurants to international quick-service chains. Prior to joining PAR in 2014, Jaskolka led the marketing function at Seneca Data (An Arrow Company). Technomic, a Winsight company, offers services ranging from major research studies and management consulting solutions to online databases and simple fact-finding assignments. Clients include food manufacturers and distributors, restaurants and retailers, other foodservice organizations, and various institutions aligned with the food industry. Email: [email protected].