Remote access to smart safes is directly impacting the bottom line through increased service efficiency and effectiveness.

By Jim Poteet

The fast-paced nature of retail and restaurant establishments requires operations to run smoothly. This is especially true in the area of cash handling. To efficiently receive, secure and ultimately deposit cash is fundamental to their success. Problems here can directly impact staff productivity, revenue, cash flow and customer satisfaction. These are all critical success factors for retail and restaurant establishments.

Cash management systems, or ‘smart safes,’ are the very nexus of this activity. If a problem arises with business-critical cash handling activities, it needs to be fixed quickly, on the first attempt. The earlier an issue is identified, with specific detail on what is causing the problem, the faster the resolution. In addition, to drive systemic improvement and reduce the occurrence of the same problem in the future, processes need to be supported by learning systems that are continuously monitored. Today’s leading smart safes can deliver these capabilities to retailers allowing them to not only realize smoother running operations, but also more effectively predict and manage their service spend. These improvements directly impact the bottom line.

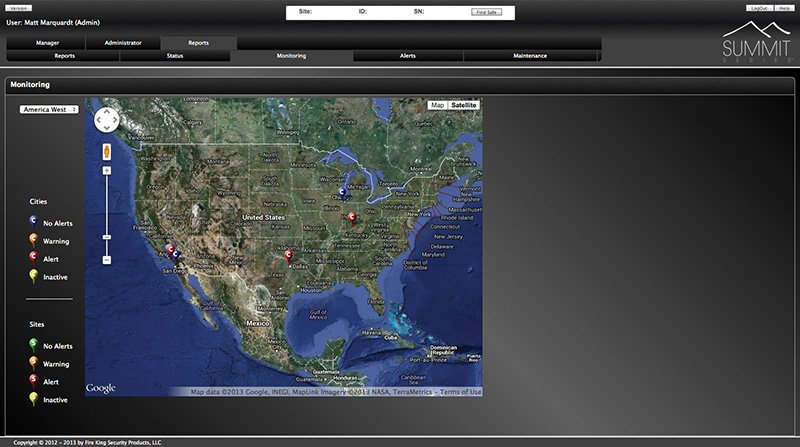

For example, consider a retailer who has note deposit and validating devices deployed across a number of locations. Many new units on the market have built-in user guides providing real-time access to help menus with step-by-step instructions which can reduce service calls, simplify training and increase staff productivity. If they are connected to a network the units can continuously exchange device health and transaction information with a central repository. Advanced systems provide full remote management access to this information via intuitive web-based service portals. Through a highly secure connection and encrypted login credentials, companies are able to maintain constant contact with their deployed devices. These portals allow a retailer’s own central support specialists to see the same information as the staff where the unit is located. With this self-help capability they can resolve many issues themselves and avoid on-site service calls, saving time and money. Furthermore, they are able to perform a comprehensive set of service activities remotely.

Remote activities include software, component firmware and accepted note denominations which can all be viewed and managed remotely. For example, the new U.S. currency will be coming out soon. Each new bill requires an update to the bill acceptors firmware in order to accurately count and validate the notes as they are inserted into the machine. Remote serviceability helps keep cash management, and therefore store operations, running smoothly by not having to divert staff to manually update the equipment or wait for a costly service technician to arrive. With the proper security credentials, an authorized central support group can directly update the firmware. These savings go directly to the retailer’s bottom line by increasing staff productivity and reducing on-site service costs.

In addition, the more advanced systems continuously monitor all the devices in a network providing real-time device status updates, along with device failure or maintenance alerts. This allows remote tracking and management of all units deployed in the field so retailers know if there is an issue before it impacts operations. For example, a retailer’s central support group may see a unit is offline and notify the store, allowing staff at the location to resolve the issue before they miss a posting cutoff. Another example may be the support group sees a CPU is running hot because the temperature is being proactively monitored. This can enable service to be performed before the device even stops working. Since remote service specialists can have access to the actual devices, they can walk store personnel through corrective actions to resolve issues, eliminating the need for a service call. If onsite maintenance is required, the service technician can arrive knowing the specific issue to be resolved, significantly increasing first time fix rates.

In addition, the more advanced systems continuously monitor all the devices in a network providing real-time device status updates, along with device failure or maintenance alerts. This allows remote tracking and management of all units deployed in the field so retailers know if there is an issue before it impacts operations. For example, a retailer’s central support group may see a unit is offline and notify the store, allowing staff at the location to resolve the issue before they miss a posting cutoff. Another example may be the support group sees a CPU is running hot because the temperature is being proactively monitored. This can enable service to be performed before the device even stops working. Since remote service specialists can have access to the actual devices, they can walk store personnel through corrective actions to resolve issues, eliminating the need for a service call. If onsite maintenance is required, the service technician can arrive knowing the specific issue to be resolved, significantly increasing first time fix rates.

Another significant service advantage of a few networked cash management systems is their plug-and-play capability eliminating the need for system setup, network configuration or software to be loaded in the field at the time of installation.  Simply plug in the power and network cables and the system draws down its configuration, including security settings so only those with clearance can access the system. System access can be granted or revoked remotely to easily respond to staffing changes. Lastly, all electronic access points, digital security and encryption protocols are continuously reviewed for vulnerabilities and updated to thwart unauthorized access and maintain system integrity. These capabilities significantly reduce deployment and maintenance time and effort. Also, when cash management processes change in the future, the system can be updated remotely to reflect the change — again without ever having to divert staff, or send a service technician.

Simply plug in the power and network cables and the system draws down its configuration, including security settings so only those with clearance can access the system. System access can be granted or revoked remotely to easily respond to staffing changes. Lastly, all electronic access points, digital security and encryption protocols are continuously reviewed for vulnerabilities and updated to thwart unauthorized access and maintain system integrity. These capabilities significantly reduce deployment and maintenance time and effort. Also, when cash management processes change in the future, the system can be updated remotely to reflect the change — again without ever having to divert staff, or send a service technician.

As retailers strive to optimize store operations and better manage their service spend, they should take a close look at a networked cash management system. The information they make available to central support groups can be instrumental in helping to increase device uptime, enhance staff productivity and streamline implementation of new cash management processes.

— Jim Poteet is executive vice president, sales and marketing, at FKI Security Group. FireKing’s advanced cash management solutions deliver the real-time business analytics required to maximize productivity and cash flow, reduce internal theft and optimize service operations. Email the author at [email protected].